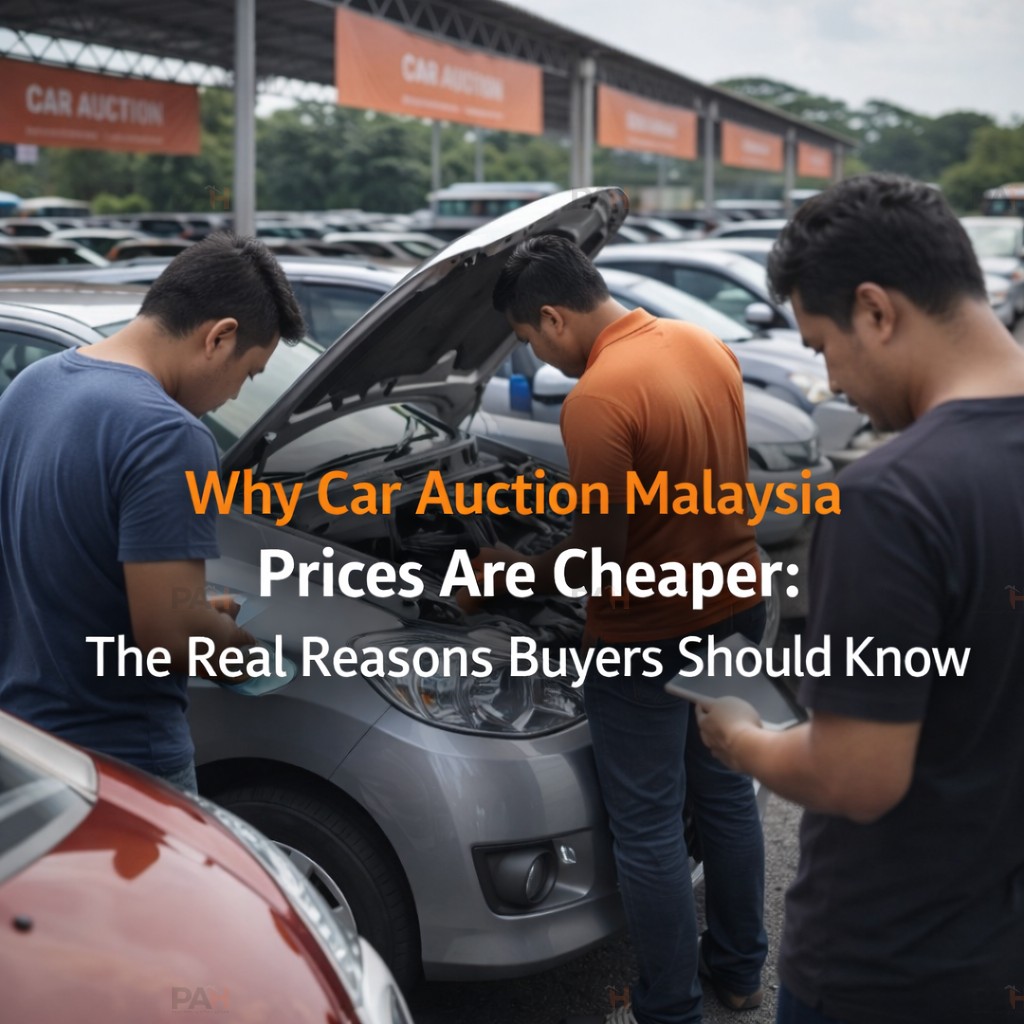

Why Car Auction Malaysia Prices Are Cheaper: The Real Reasons Buyers Should Know

Many buyers notice that car auction Malaysia prices are often lower than dealer listings. This price gap is not random—it reflects how auction supply is sourced, how prices are formed, and which costs are excluded.

This guide explains the pricing mechanics, so buyers can judge value accurately instead of assuming “cheap = risky.”

1) Recovery-Driven Selling, Not Retail Profit

A large portion of auction cars come from:

bank and finance repossessions

fleet and end-of-lease disposals

Pricing effect: sellers prioritize speed of recovery, not maximizing retail margins.

2) No Dealer Mark-Ups or Reconditioning Premiums

Dealer prices typically include:

refurbishment and detailing

showroom overheads

warranty buffers and commissions

Pricing effect: auctions remove these layers, passing savings to buyers.

3) Limited Inspection Lowers Bid Appetite

Because inspections are restricted:

fewer bidders compete aggressively

buyers demand a risk discount

Pricing effect: prices adjust downward to compensate for uncertainty.

4) Time Pressure Creates Value Windows

Auctions operate on fixed schedules:

vehicles must clear by set dates

repeated auctions may follow if unsold

Pricing effect: urgency suppresses price escalation.

5) Competitive Discovery Rewards Prepared Buyers

Prices are discovered through live bidding:

strong research = strong value

weak preparation = overpayment risk

Pricing effect: informed buyers capture discounts.

The Smart Way to Use Cheaper Prices

Lower prices work only when buyers:

benchmark resale accurately

include repair and time buffers

maintain bidding discipline

FAQ

Q1: Are cheaper auction cars lower quality?

Not necessarily—pricing reflects structure, not just condition.

Q2: Why do similar cars sell at very different prices?

Bidder competition and timing drive outcomes.

Q3: Can auction prices rise above market?

Yes, when competition becomes emotional.